Photo by Sawyer Bengtson on Unsplash

Section 1

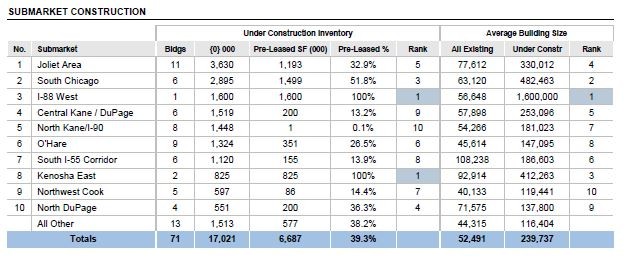

Currently Chicago has 17,021,310 feet under construction, the pipeline is slowing but projects already started are moving ahead to completion. 39.3% pre-leased. Chicago developers feel a healthy ratio here is 50% pre-leased so we’ve dropped under that a bit. Joliet area up I-55 through Bolingbrook has the most activity right now with 17 buildings U/C representing 4,750,000 SF. Only 28.4% is pre-leased.

Section 2

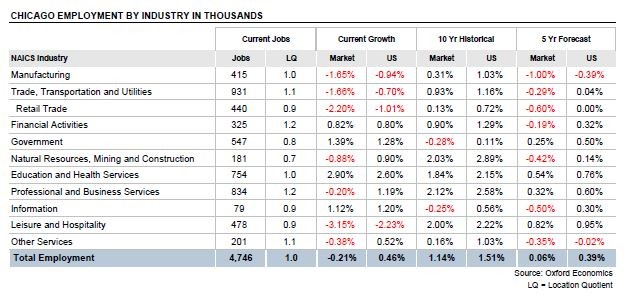

Employment in Chicago Market

- Currently a net loss of -0.21% in the job market (roughly 10,000 jobs in the last 3 weeks)

- Oxford Economics is forecasting a loss of 177,000 jobs in Q2 2020 but a gain of 160,000 in the back-half of 2020 with Chicago finishing with 17,000 fewer jobs in total at the end of 2020.

- To give perspective Chicago lost 325,000 jobs in the last downturn.

- Current jobs stand at 4.75M

Section 3

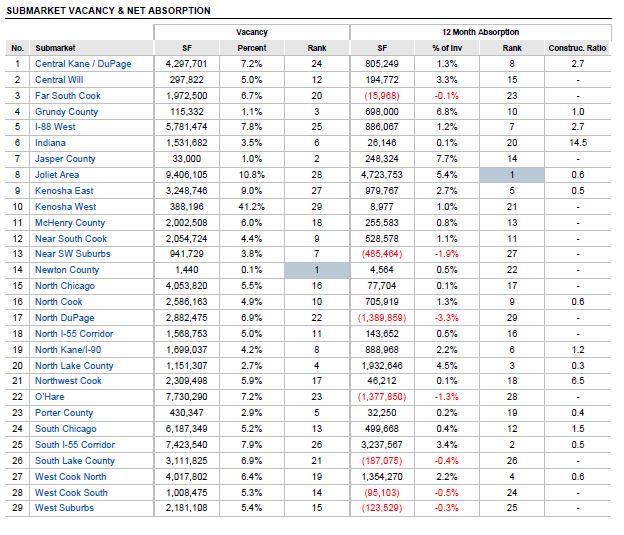

Highest Vacancy & Lowest Vacancy Markets

- Highest Joliet, Kenosha, and I-55 (8-10%)

- Lowest North Lake, NW Indiana, & Near SW Suburbs (2.7-3.8%)

Section 4

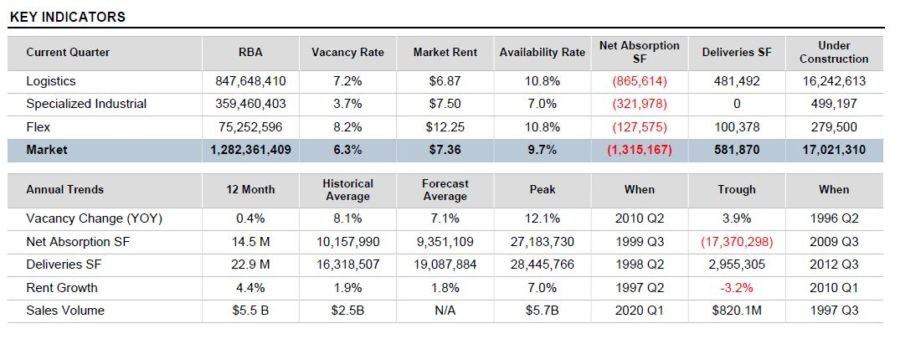

Vacancy overall in Chicago market was 5.9% at the end of 2019 with 74.7M SF vacant.

- Currently stands 6.3% vacant, which represents 80,635,188 SF

- Forecasters are saying 6.6% by end of 2020 which would bring our vacant SF to 85M.

Current quarter alone we’ve seen negative absorption across the whole market of 1,315,167 SF (0.102%) the quarter is only 3 weeks old so we expect this to rise substantially over the coming 30 days.

Section 5

Market Anecdotes*

- Industrial property management divisions have seen 75% of their tenants still operating their facilities.

- Showing velocity is down somewhere between 60%-70%

- Capital Markets and New Development deals seem to pause on pause for at least the next 30 days

- Lenders are still looking at deals in the industrial space while even sectors that have been strong like multifamily are hard to underwrite in the current environment and they’ve had mixed results compared to industrial.

- Economic Shocks have been asymmetric some companies are busier than ever (ex. e-commerce & grocery), others have had the spicket shut off entirely (Ex. Airline suppliers, hotel & restaurant suppliers, event rentals)

- Pricing on rent and sales have yet to adjust, but May 1st will be a very big potential turning point depending on the damage to the economy in April and ability of companies to pay loans, rent, mortgage, and employees.

- Many governmental programs are available for you and your employees – click here to find a summary of things you, your tenants, vendors, and customers should have applied for already. There has been much talk of a second round of stimulus and applications are still being approved so we encourage everyone to get on this ASAP!

*No data to back these claims, but they’re based on discussions with other professionals over the last month.