Cawley Commercial Real Estate’s industrial experts pull the top stats for leases, sales, and projects under construction in Chicago’s industrial real estate market every quarter in order to get a clear idea of where the market is and where it is going. Cawley also covers the I-88 West and South I-55 corridor industrial real estate markets comparatively.

The suburban Chicagoland industrial market has seen unprecedented velocity and rent growth over the last few years, which most outsiders are already aware of. Where activity has been particularly ferocious over the last 4-6months has been in the I-55 and I-80 submarkets. Throughout 2018, both of these pockets were considered to be overbuilt by many industry experts, with multiple 1m SF+ speculative developments sitting empty for a period of time.

Q3 produced four industrial lease transactions in excess of 3,400,000 SF in the I-55/I-80 submarket with tenants such as: Target, Amazon, RJW Logistics, and Crate & Barrel. Demand for big box facilities in these strategic locations is driven by proximity to major expressways, access to skilled and unskilled labor, as well as access to both the BNSF Logistics Park Chicago and Union Pacific Joliet Intermodal. Companies utilize the intermodals to keep shipping costs minimal.

Based on current supply and demand trends, steady rent growth in most of the Chicagoland market, and continued capital interest from the investment market, the outlook for 2020 Industrial Real Estate is all positive.

– Jack Brennan, Senior Associate / Industrial Specialist @ Cawley Commercial Real Estate

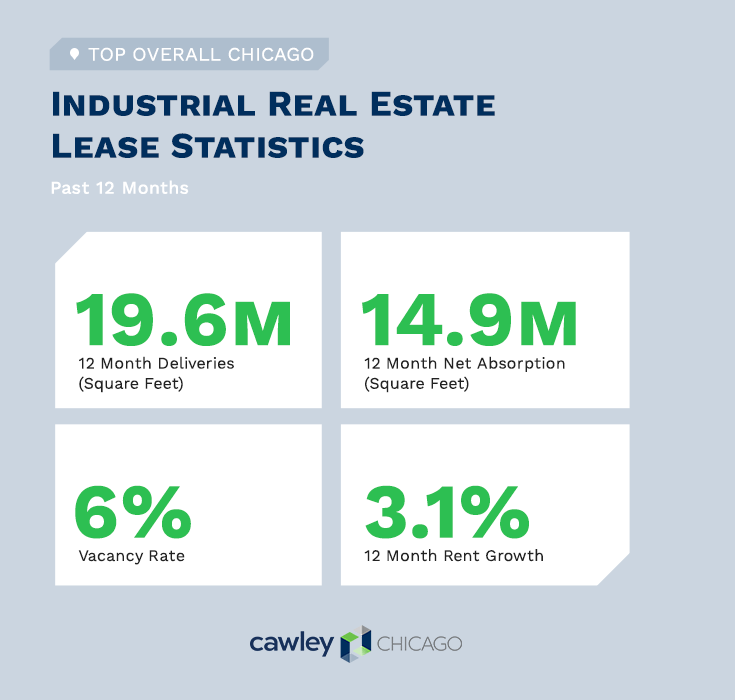

Top Overall Chicago Industrial Real Estate Lease Statistics

12 Month Deliveries (Square Feet): 19.6 million

12 Month Net Absorption (Square Feet): 14.9 million

Vacancy Rate: 6%

12 Month Rent Growth: 3.1%

Top Chicago Industrial Leases (Past 12 Months)

1) Property: 3300 Channahon Rd

Submarket: Joliet Area

Leased SF: 1,220,140

Quarter: Q3 2019

Leasing Rep: NAI Hiffman

2) Property: 120th Ave & 122nd St

Submarket: Kenosha East

Leased SF: 590,525

Quarter: Q1 2019

Tenant: Fresenius Kabi

Tenant Rep: CBRE

Leasing Rep: Cushman & Wakefield

3) Property: 2850 Duke Oky

Submarket: 1-88 West

Leased SF: 549,588

Quarter: Q2 2019

Tenant: Wholesale Interiors

Leasing Rep: Colliers International

4) Property: 20100 Renwick Rd

Submarket: South I-55 Corridor

Leased SF: 543,780

Quarter: Q4 2019

Tenant: RJW Logistics

Leasing Rep: Cushman & Wakefield

5) Property: 2602 128th Ave

Submarket: Kenosha East

Leased SF: 524,339

Quarter: Q2 2019

Tenant: Sligan Containers Corp

Leasing Rep: CBRE

Top Chicago Industrial Sales Statistics (Past 12 Months)

Sales Comparables: 1,317

Average Cap Rate: 8.5%

Average Price/ SF: $67

Average Vacancy at Sale: 14.4%

Top Chicago Industrial Property Sales

1) Property: Bldg 1 (1955 W North Ave)

*Rating: 3

Year Built: 1955

Building SF: 1,561,613

Vacancy: 0%

Price (PSF): $125,000,000 ($80)

Cap Rate: 6.3%

2) Property: FedEx Distribution Center (5959 W Howard St)

*Rating: 4

Year Built: 2015

Building SF: 314,202

Vacancy: 0%

Price (PSF): $84,262,035 ($268)

Cap Rate: 5.7%

3) Property: 930 W Evergreen Ave

*Rating: 4

Year Built: 1998

Building SF: 280,500

Vacancy: 67.9%

Price (PSF): $73,284,000 ($261)

Cap Rate: Not Listed

4) Property: 525 Northwest Ave

*Rating: 5

Year Built: 2015

Building SF: 588,536

Vacancy: 0%

Price (PSF): $70,600,000 ($120)

Cap Rate: 4.5%

15 Property: Building 1 (2357 S Wood St)

*Rating: 5

Year Built: 2017

Building SF: 227,043

Vacancy: 0%

Price (PSF): $68,683,000 ($303)

Cap Rate: Not Listed

*Rating is 1-5, 5 being the best

Chicago Industrial Construction Projects Statistics

Properties Currently Under Construction: 89

Total Size: 20,133,521 SF

Percent of Inventory: 1.7%

Preleased: 31.1%

Top Chicago Industrial Projects Under Construction

1) Property: Steiner Rd & 143rd St

Rating*: 3

Building SF: 1,500,000

Stories: 1

Completion: Q1 2020

Developer/ Owner: Seefried Properties Inc

2) Property: Northpoint’s Avenue O (11600 S Avenue O)

Rating*: 3

Building SF: 1,197,000

Stories: 1

Completion: Q1 2020

Developer/ Owner: NorthPoint Development

3) Property: Exchange 55 (3501 S Pulaski Rd)

Rating*: 5

Building SF: 999,900

Stories: 1

Completion: Q4 2020

Developer/ Owner: Shapack Partners / Walton Street Capital LLC

4) Property: Orchard Gateway (I-88 & Orchard Rd)

Rating*: 3

Building SF: 764,895

Stories: 1

Completion: Q3 2020

Developer/ Owner: Panattoni Development Company

5) Property: 9401 Grand Ave

Rating*: 4

Building SF: 756,714

Stories: Not Listed

Completion: Q4 2019

Developer/ Owner: Digital Realty Thrust

*Rating is 1-5, 5 being the best

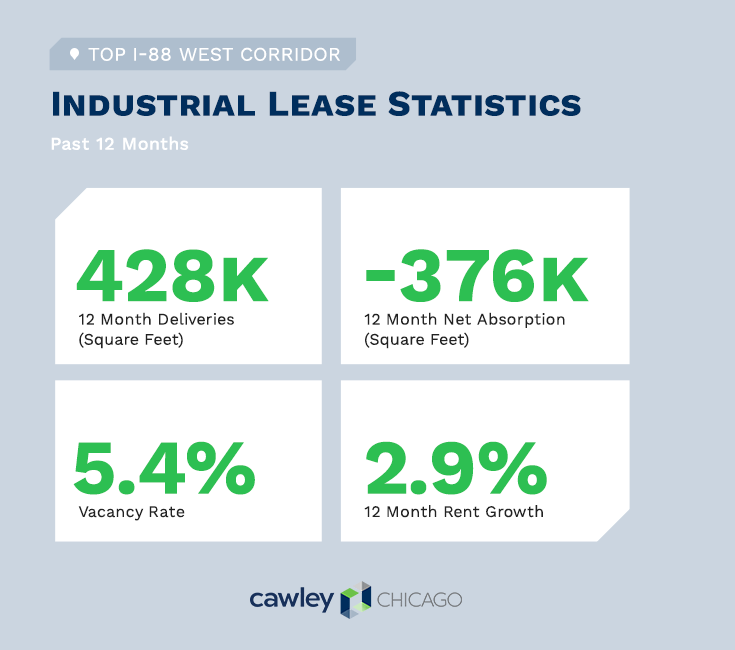

Top I-88 West Corridor Industrial Lease Statistics (Past 12 Months)

12 Month Deliveries (Square Feet): 428K

12 Month Net Absorption (Square Feet): -376K

Vacancy Rate: 5.4%

12 Month Rent Growth: 2.9%

4 & 5 Star Industrial Properties Leasing Activity in I-88 West Corridor (Past 12 Months)

1) Property: Jefferson Business Center (1748 W Jefferson Ave)

Rating: 4

Deals: 2

Square Feet: 68,932

Vacancy: 59.3%

Net Absorption: 40,110

2) Property: 1998 Melissa Ln

Rating: 4

Deals: 2

Square Feet: 103,949

Vacancy: 67.6%

Net Absorption: 0

3) Property: 2119 Fisher Drive

Rating: 4

Deals: 1

Square Feet: 104,957

Vacancy: 100%

Net Absorption: 0

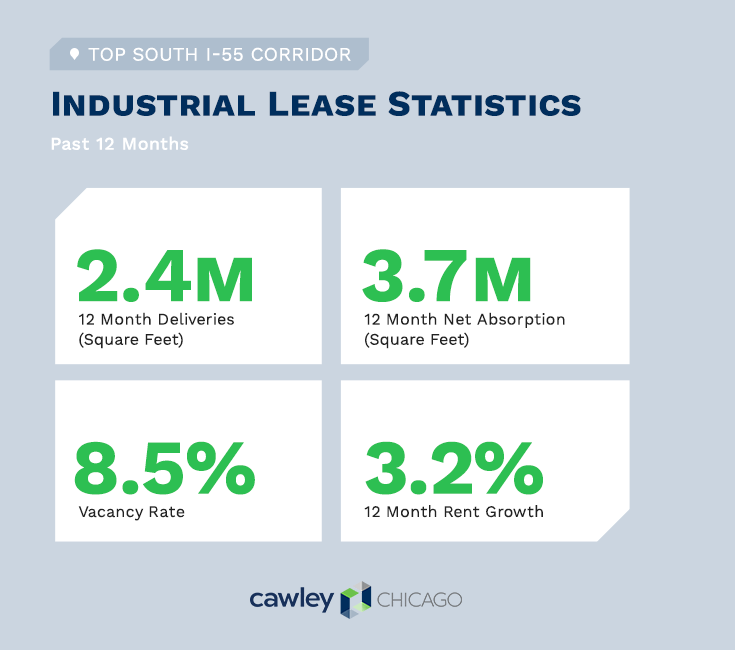

Top South I-55 Corridor Industrial Lease Statistics (Past 12 Months)

12 Month Deliveries (Square Feet): 2.4M

12 Month Net Absorption (Square Feet): 3.7M

Vacancy Rate: 8.5%

12 Month Rent Growth: 3.2%

4 & 5 Star Industrial Properties Leasing Activity in South I-55 Corridor (Past 12 Months)

1) Property: 850-880 Remington Blvd

Rating: 4

Deals: 1

Square Feet: 50,338

Vacancy: 0%

Net Absorption: 50,338

2) Property: 101 Paragon Dr

Rating: 4

Deals: 2

Square Feet: 44,865

Vacancy: 58.6%

Net Absorption: 44,865

3) Property: 1049 Lily Cache Ln

Rating: 4

Deals: 2

Square Feet: 62,873

Vacancy: 0%

Net Absorption: 0

Top I-88 West Industrial Sales Statistics (Past 12 Months)

Sales Comparables: 77

Average Cap Rate: 9.6%

Average Price/ SF: $71

Average Vacancy at Sale: 8.2%

Top I-88 West Industrial Real Estate Property Sales

1) Property: Space Center Aurora II (2580 Prospect Ct)

*Rating: 4

Year Built: 1998

Building SF: 650,000

Vacancy: 0%

Price (PSF): $39,596,000 ($61)

Cap Rate: Not Listed

2) Property: Butterfield I (2702 Eola Rd)

*Rating: 4

Year Built: 1997

Building SF: 252,946

Vacancy: 0%

Price (PSF): $20,625,000 ($82)

Cap Rate: Not Listed

3) Property: BYTEGRID’s Chicago (4267 Meridian Pkwy)

*Rating: 2

Year Built: 2007

Building SF: 70,000

Vacancy: 0%

Price (PSF): $20,500,000 ($293)

Cap Rate: Not Listed

Top South I-55 Industrial Sales Statistics (Past 12 Months)

Sales Comparables: 54

Average Cap Rate: 7.4%

Average Price/ SF: $92

Average Vacancy at Sale: 19.7%

Top South I-55 Industrial Real Estate Property Sales

1) Property: Building III (700 Weber Rd)

*Rating: 5

Year Built: 2015

Building SF: 602,820

Vacancy: 0%

Price (PSF): $60,560,366 ($100)

Cap Rate: Not Listed

2) Property: Inventory Facility II (1150 W 115th St)

*Rating: 5

Year Built: 2008

Building SF: 453,090

Vacancy: 59.5%

Price (PSF): $45,518,225 ($100)

Cap Rate: Not Listed

3) Property: Building III (700 Weber Rd)

*Rating: 5

Year Built: 2015

Building SF: 602,820

Vacancy: 0%

Price (PSF): $28,937,904 ($96)

Cap Rate: Not Listed

I-88 West Industrial Construction Projects Statistics

All-Time Annual Average Square Feet: 157,276

Delivered SF (Past 4 Qs): 303,694

Delivered SF (Next 4 Qs): 2,337,908

Proposed SF (Next 4 Qs): 1,196,038

Top I-88 West Industrial Projects Delivered

1) Property: 540 Frontenac Rd

Rating*: 4

Building SF: 131,040

Stories: 1

Completion: Q2 2019

Developer/ Owner: Peak Construction Corp / City of Naperville

2) Property: 1998 Melissa Ln

Rating*: 4

Building SF: 172,654

Stories: 1

Completion: Q1 2019

Developer/ Owner: The Missner Group Co / First Industrial Realty Trust Inc

Top I-88 West Industrial Projects Under Construction

1) Property: Steiner Rd & 143rd St

Rating*: 3

Building SF: 1,500,000

Stories: 1

Completion: Q1 2020

Developer/ Owner: Seefried Properties Inc

1) Property: Butterfield Center (2350 Frieder Ln)

Rating*: 4

Building SF: 503,244

Stories: 1

Completion: Q4 2019

Developer/ Owner: Sterling Bay / Theodore Novak

South I-55 Industrial Construction Projects Statistics

All-Time Annual Average Square Feet: 407,292

Delivered SF (Past 4 Qs): 2,036,727

Delivered SF (Next 4 Qs): 1,810,015

Proposed SF (Next 4 Qs): 3,591,150

Top South I-55 Industrial Projects Delivered

1) Property: Interchange 55 Logistics (901-1001 W Bluff Rd))

Rating*: 5

Building SF: 684,320

Stories: 1

Completion: Q3 2019

Developer/ Owner: CT Realty Investors

2) Property: Airport Logistics Center 1 (20100 Renwick Rd)

Rating*: 5

Building SF: 543,780

Stories: 1

Completion: Q3 2019

Developer/ Owner: Duke Realty Corporation

Top South I-55 Industrial Projects Under Construction

1) Property: 775 Veterans Pkw

Rating*: 5

Building SF: 573,752

Stories: 1

Completion: Q2 2020

Developer/ Owner: Not Listed / Trammell Crow Residential

2) Property: Romeoville Gateway (Route 53 & Joliet Rd)

Rating*: 4

Building SF: 351,870

Stories: 1

Completion: Q1 2020

Developer/ Owner: IDI Logistics / Vynera Transportation Inc

Data Sources: Cawley Commercial Real Estate & CoStar